Rolling debt payoff calculator

Then take what you were paying on that debt and add it to the payment of your next smallest debt. But rememberan investment calculator doesnt replace professional advice.

Free Debt Snowball Calculator How Soon Could You Be Debt Free

Most users are eligible for a line of credit with a variable APR from 790 to 2999.

. See how our debt avalanche calculator can help you minimize the interest charges and accelerate debt repayments if you have multiple debts. As a result youll be. The Debt Payoff Calculator above can accommodate a one-time extra payment or multiple periodic extra payments either separately or combined.

Mortgage rates valid as of 31 Aug 2022 0919 am. When that snowball starts rolling itll give you the momentum you need to get out of debt for good. In fact you can.

You focus on paying debts with the highest interest rates. Having a strong credit history and debt-to-income ratio could help you score a low interest rate even without a cosigner just ensure you can receive a lower rate than with federal loans. Student Loan Payoff Calculator 14-Day Money Finder Retirement and Investing.

For example some banks mail the document. Make minimum payments on all debts except the smallestthrowing as much money as you can at that one. Generally speaking points are not a great deal if you plan to sell the home soon but if you plan to live on the home for many years or perhaps throughout the duration of the loan buying points can save you money.

Once that debt is gone take its payment and apply it to the next smallest debt while continuing to make minimum payments on the rest. The average household carries more than 9000 in credit card debt. Other debt payoff methods.

Consult a financial coach. Use our calculator to see how it works. Make minimum payments on all your debts except the smallest.

However no guarantee is made to accuracy and the publisher specifically. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Use this calculator to compare the full cost of a loan with discount points to one without them.

FICO is slowly rolling out the UltraFICO. A credit score ranges from 300 to 850 and is a numerical rating that measures a persons likelihood to repay a debt. If you need help with your investments we recommend working with an expert wholl help you understand what youre investing in.

The Debt Snowball Calculator shows the benefits of applying the payments of recently paid-off debts to. Youd just be making payments on a new phone yeah that counts as debt all while it hikes up your phone bill even more. Not rolling over payments youre making on your highest-interest debt to the next highest-interest.

A higher credit score signals that a borrower is lower risk and more likely to make on-time payments. Credit Card Payoff Calculator. Youll have more money on hand to hit your goals each.

Variable APR or 499 per month Tally is one of your best options for consolidating credit card debt. Get 247 customer support help when you place a homework help service order with us. Then use that budget we mentioned to cut back on your spending and throw even more money at your debt.

These debt reduction programs and apps help people craft a plan to dig their way out of debt once and for all. Repeat this method as you plow your way through debtThe more you pay off the more your freed-up. Expect to pay a modest fee for a payoff letter but in some cases the service is freeThe cost might depend on how you get the letterask customer service for details.

Each calculator available for use on this web site and referenced in the following directories - finance calculator retirement calculator mortgage calculator investment calculator savings calculator auto loan calculator credit card calculator or loan calculator - is believed to be accurate. Going to a restaurant or hitting up the drive-thru is. Use this free debt snowball calculator to see how quickly you can pay off debt.

An investment calculator is a simple way to estimate how your money will grow if you keep investing at the rate youre going right now. Continuing to build debt on credit cards and loans. An undergraduate applying for the governments direct subsidized and unsubsidized loans would be handed a 275 interest rate up until July 1 2021.

These are fees for things like mortgage origination and transfer taxes. Because just like a snowball rolling downhill paying off debt is all about momentum. And they can be quite expensive.

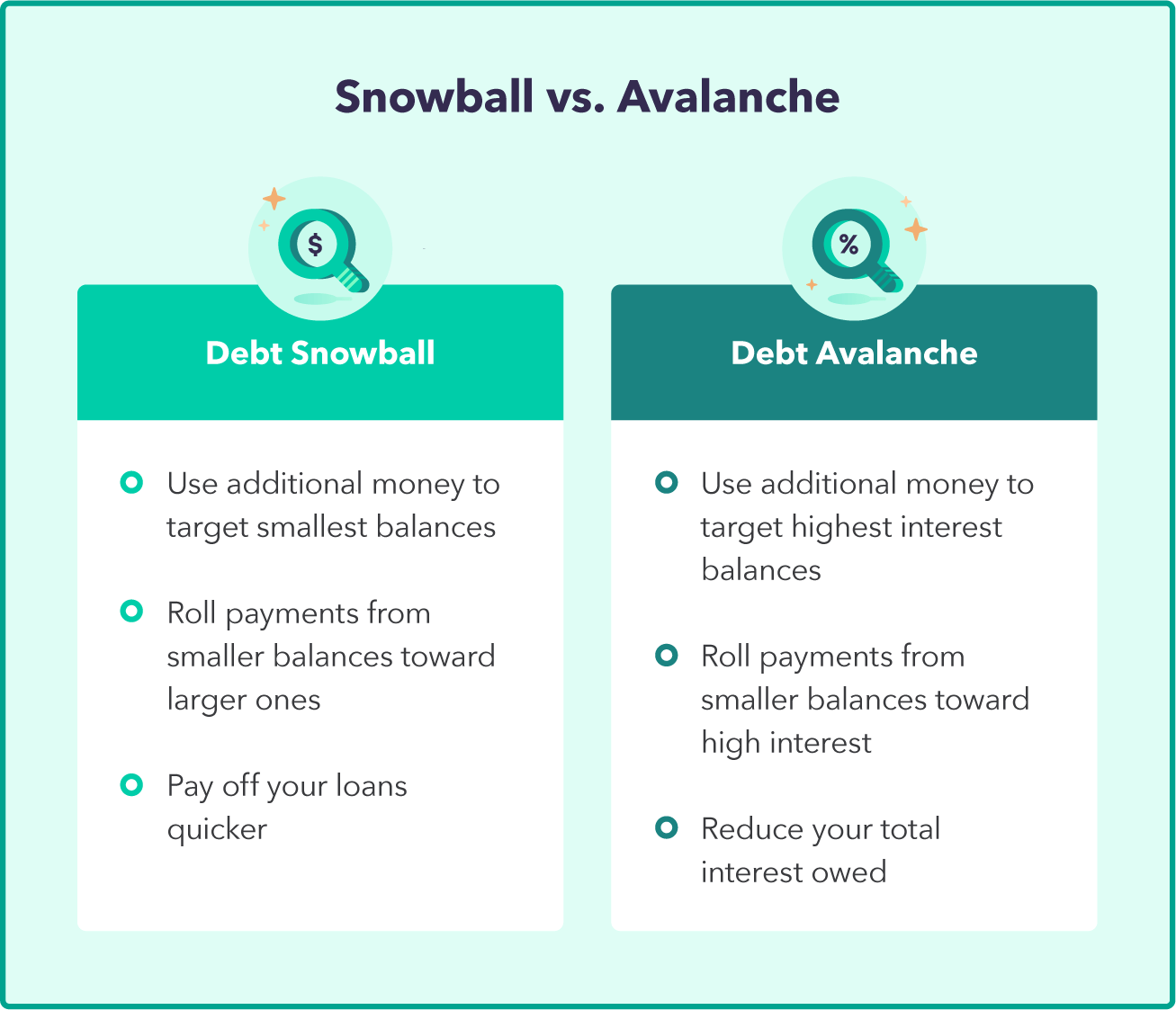

Also compares the snowball method withh the debt avalanche method. Now before you start arguing about the interest rates hear us out. List your debts from smallest to largest regardless of interest rate.

ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years for. Put that 100 cable bill toward your debt each month and watch just how quickly your debt snowball starts rolling. Once the smallest debt is gone take that payment and apply it to the next-smallest debt.

With every debt you pay off you gain speed until youre an unstoppable debt-crushing force. Our debt snowball calculator shows how to accelerate your debt payoff. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance.

Minimum debt payments might help you get out of debt eventually but its a slow process. Steer clear of rolling the cost of a brand-new phone into your wireless bill. With debt snowball you pay off smaller debts first then pay your larger debts.

Knock out the smallest debt first. Explore personal finance topics including credit cards investments identity. Before deciding to pay off a debt early borrowers should find out if the loan requires an early payoff penalty and evaluate whether paying off that debt faster is a wise decision financially.

If your largest debt has the largest interest rate its going. Stop going out to eat. Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher.

Try this calculator to see how your debt payoff schedule can be optimized by rolling the payments into an effective long-term strategy. Repeat until each debt is paid in full. Debt avalanche can save you time and money during debt payoff.

If you havent cut the cord yet do it. When you purchase a home you are going to have to pay closing costs. Pay as much as possible on your smallest debt.

Grow with time and build momentum and effectiveness much like a snowball rolling down a hill.

9 Debt Snowball Calculators To Supercharge Your Debt Payoff

Debt Snowball Tracker Printable Debt Payment Worksheet Etsy Debt Snowball Debt Snowball Worksheet Credit Card Debt Payoff

Debt Snowball Calculator Debt Snowball Debt Payoff Worksheet

Credit Card Payoff Calculator Excel And Google Sheets Free Download

Debt Snowball Spreadsheet Moneyspot Org

Debt Snowball Spreadsheet Moneyspot Org

Debt Payoff Calculator Estimate Your Debt Free Date Credello

Debt Payoff Calculator Estimate Your Debt Free Date Credello

How To Pay Off Debt And Create Your Own Debt Payoff Calculator

Debt Snowball Payoff Calculator See Your Payoff Date Nerdwallet

Free Credit Repair Spreadsheet Improve Your Credit Score

9 Debt Snowball Calculators To Supercharge Your Debt Payoff

9 Debt Snowball Calculators To Supercharge Your Debt Payoff

Debt Snowball Spreadsheet Moneyspot Org

Using Debt Snowball Worksheets To Wipe Out Debt

Debt Reduction Calculator Tutorial Use A Debt Snowball To Pay Off Debt Youtube

Debt Snowball Calculator The Debt Snowball Method Simplified Mintlife Blog

Komentar

Posting Komentar